Introducing the free GFTM Platform

GFTM - helping stop bad debt.

Every year, each SME loses on average £40,000 to bad debt. This is just plain wrong.

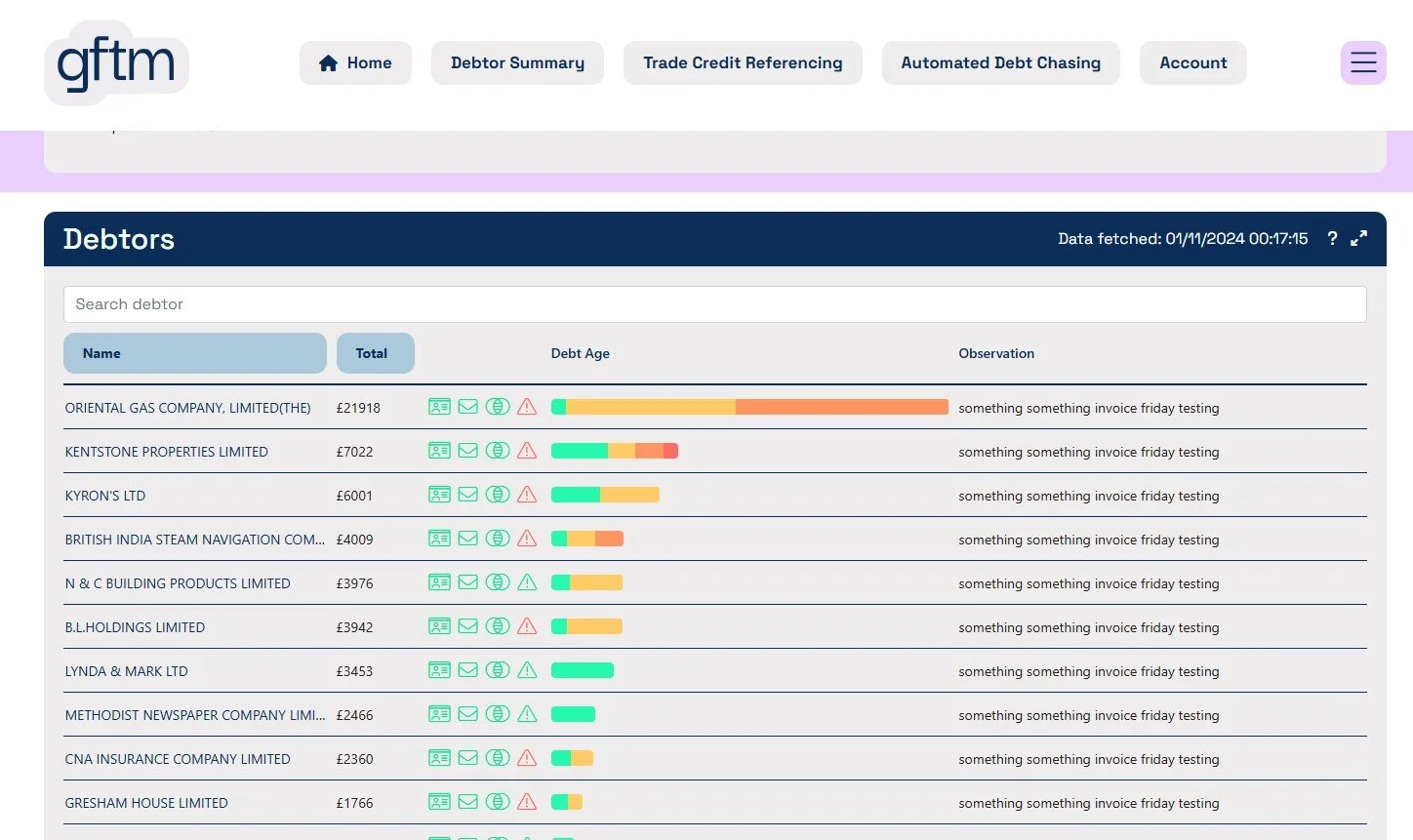

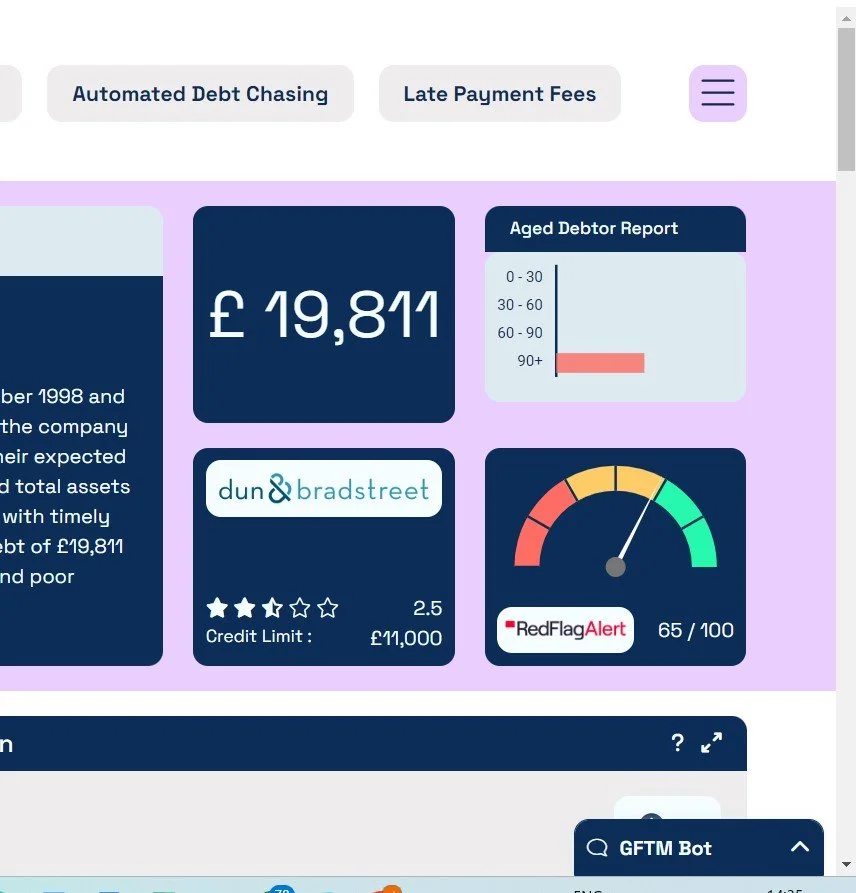

GFTM began as a platform that helps SMEs share real-time payment and credit information on customers they have in common, giving suppliers visibility that traditional credit agencies can’t provide. By syncing with accounting systems, the platform builds a live picture of debtor behaviour, highlights slow-paying accounts and flags emerging bad-debt risk across supplier networks. This shared insight helps businesses spot problems earlier and reduce unexpected losses.

Alongside data-sharing, GFTM provides free credit ratings and automated trade credit referencing, allowing users to request, view and compare up-to-date credit information on customers and prospects.

Multiple data sources and contributor inputs are combined into practical, supplier-focused credit views, helping SMEs make faster and more confident credit decisions without relying solely on outdated, filed accounts.

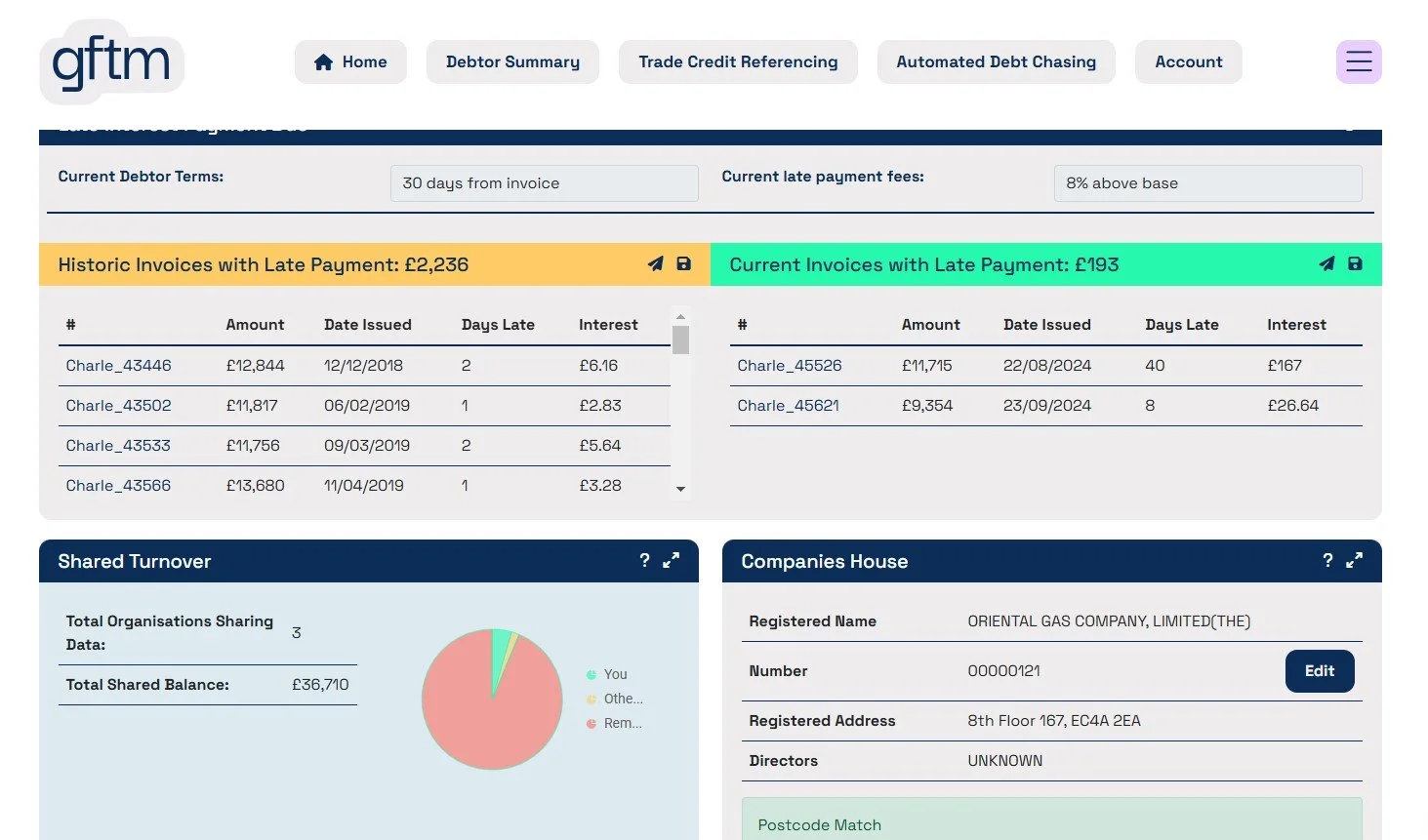

Automated Statements, with late interest

GFTM will provide you with fully calculated statements for any customer, showing invoice by invoice the issue date, due date, paid date and any interest owed for a 6 year period.

Automated statements can be downloaded and sent directly to customers.

The threat of these fees is often the necessary incentive to get customers to pay, and pay on time thereafter.

For some clients, such as local authorities and large corporations, these fees will be accepted and paid out.

But the fact that these fees are being included in some chasing emails will remind customers that they have a duty to pay on time.

Contact us now, and start using the free service today.

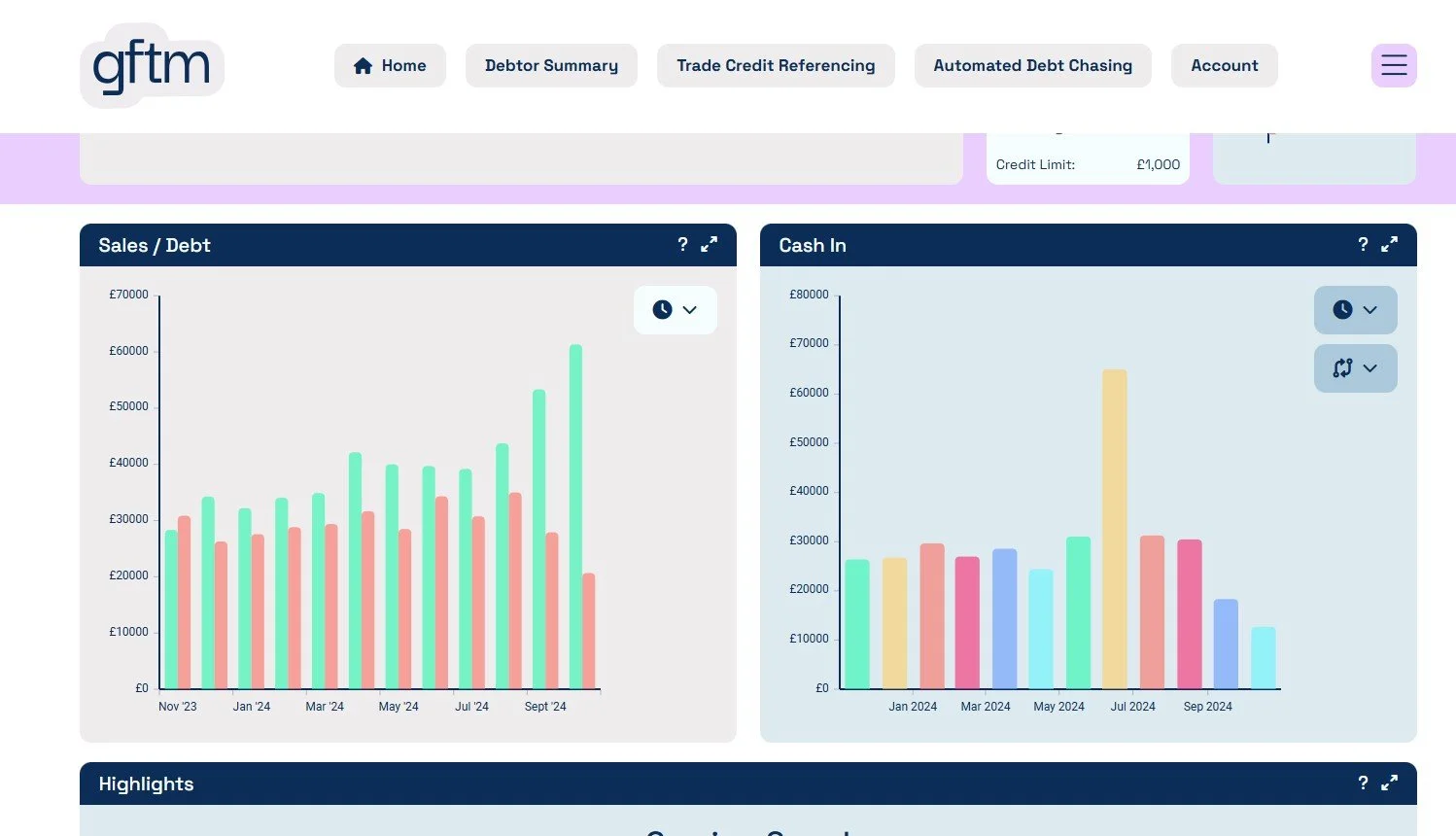

Automated AI debt chasing

There’s more to debt chasing than just endlessly sending out the same emails again and again.

GFTM provides the best in class debt chasing software, all for free.

We will monitor your accounting package and send out chaser emails as and when debts become due.

But we are more than that: we will look at past relationships to gauge how we write. Loyal customers who may have slipped up are given a gentle friendly reminder. We look at past payment histories, and analyse whether chasing emails have been opened and read.

All of this done automatically. You simply choose which customers (if any) you would like chased, and we just get on with it.